Equipment Needed to Start a Farm

Starting a farm can be an exciting and rewarding venture. Whether you plan to focus on livestock farming or...

Fund your operation through an annual revolving operating loan.

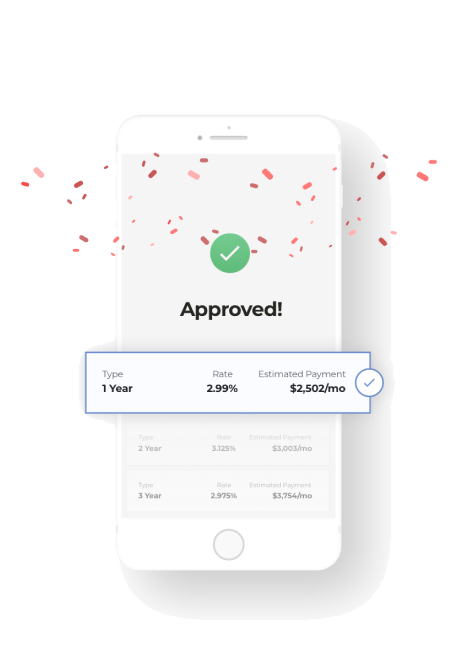

AFF offers fixed and variable rate operating loans for 12 – 16 months. Apply for up to $1m – we’ll let you know the maximum we can approve.

AFF operating loans can also be used to finance crops and barns.

Let us help get you the best loan terms on the market in the shortest time possible.

We do not charge origination or servicing fees.

If you apply from April through August, payback is traditionally the following March. If you apply from September through March, payback will traditionally be March in the next year. As an example, an application in September 2023 would be due in March 2025.

Nope! We offer fixed and variable rate operating loans. Approval is for both loan options and you can select your desired rate online.

Yes! If you are approved, you are approved for all products. You only need to decide on a product when booking the loan.

We accept applications up to $1 million. If you apply for an amount higher than we can approve, we will let you know our maximum approval amount. We do perform a hard credit check at submission.

You will hear from a member of the American Farm Financing team and our Servicer, Compeer Financial to close your loan.

We can close a loan in as little as two business days. We do ask applicants to have a picture of a driver's license and entity documents (if applicable) at the ready.

You can apply for an operating loan on existing acres that you farm or on new acres you are adding.

Our easy-to-use digital Ag financing applications take a few minutes to complete from any device.

You’ll learn if you’re approved for any of our Ag loans as soon as you hit submit - no waiting around for bankers or paperwork.*

We’ll confirm your information and work through all closing to-dos (including appraisal and title work for farmland or equipment loans).

Our fully digital closing process means your farming operation never gets disrupted - get back to doing what you love with more time and money in your pocket.

Use our loan calculators or helpful blog posts to prepare you for all your farm financial considerations.

Starting a farm can be an exciting and rewarding venture. Whether you plan to focus on livestock farming or...

https://youtu.be/92RGvMVIUCE 7 Effective Strategies1. Write a Goodwill Letter: If your credit report shows a minor blemish, such as a single...

Whether you're a seasoned farmer or just starting, this guide aims to help you navigate the world of grants...

Entrepreneur

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua Ut enim ad minim veniam

CEO Bciaga

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua Ut enim ad minim veniam

Businessman

Whether you’re just starting out or have been operating family farmland for generations, we make access to farm capital simple, secure, and affordable.

Use our cash rent loan as a secondary source of capital to your operating loan.

Fixed rates available up to seven years. No origination fees.

Secure up to a 30-year fixed mortgage. No origination fees.

Refinance into a shorter term loan or take equity out of your land.

Stay up to date with the latest blog posts, offerings, and AFF news.

*Online approval is for qualified applicants only. Loan approval is based on creditworthiness and other factors. Not every application will be approved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua Ut enim ad minim veniam